Home » Archives for 2017

JCT distribution tables

Courtesy Greg Mankiw, the Joint Committee on Taxation distributional analysis of the new tax law.

Bottom line: No change. Income categories are paying almost exactly the same share of federal taxes as before. Millionaires actually pay a tiny bit larger share in the new bill.

Given the distributional hue and cry, frankly, it is a surprise to me just how tiny -- far below measurement errors -- the changes are.

One can argue whether this is the "right" measure of progressivity or redistribution, whether a tax cut should include a change in which income categories pay what share. But it summarizes the facts, which are stubborn things. Shares of federal taxes paid by income groups do not change. Millionaires get bigger dollar tax cuts exactly to the extent that they pay higher taxes. Period.

Note to those outside the beltway: The Joint Committee on Taxation is the committee set up by Congress to evaluate tax policy. Most criticism I've seen of its calculations lately come from the right.

Bottom line: No change. Income categories are paying almost exactly the same share of federal taxes as before. Millionaires actually pay a tiny bit larger share in the new bill.

Given the distributional hue and cry, frankly, it is a surprise to me just how tiny -- far below measurement errors -- the changes are.

One can argue whether this is the "right" measure of progressivity or redistribution, whether a tax cut should include a change in which income categories pay what share. But it summarizes the facts, which are stubborn things. Shares of federal taxes paid by income groups do not change. Millionaires get bigger dollar tax cuts exactly to the extent that they pay higher taxes. Period.

Note to those outside the beltway: The Joint Committee on Taxation is the committee set up by Congress to evaluate tax policy. Most criticism I've seen of its calculations lately come from the right.

MR wisdom

Best sentence award:

France -- supposedly bureaucratic, dirigiste, labor-protected France -- builds subways and high speed trains for far less than we pay. Something about the US government makes us singularly inefficient in public expenditures. Don't expect the French health care model to cost the same here either.

A prime candidate, in my view, is the US habit of federal financing plus state and local decision making. Local politicians who are spending national taxpayer money have very little incentive to reduce costs.

"It will not escape notice that New York buys subway construction the way all of America buys health care."-Alex Tabarrok, Marginal Revolution, covering an excellent New York Times article on why subway construction in New York is so insanely expensive.

France -- supposedly bureaucratic, dirigiste, labor-protected France -- builds subways and high speed trains for far less than we pay. Something about the US government makes us singularly inefficient in public expenditures. Don't expect the French health care model to cost the same here either.

A prime candidate, in my view, is the US habit of federal financing plus state and local decision making. Local politicians who are spending national taxpayer money have very little incentive to reduce costs.

Economists as Public Intellectuals

I ran across a video by my former Chicago Booth colleague Austan Goolsbee that prompts some reflection on the role of economists as public intellectuals. (In addition to my gentle scolding of Greg Mankiw in the last post.)

Austan:

It is not, in fact, "Donald Trump's" tax plan. It is, clearly, a tax plan hashed out by Republicans in Congress, with some input from the administration, mostly the Treasury department. Almost nothing in this comes form Donald Trump. Just how many nights was President Trump up late on his laptop sweating over the income and depreciation limits of pass-through income deductions? Not many, I'd wager. So why is Austan calling it "Donald Trump's tax plan," not (say) "Congressional Republican's tax plan?"

Once you ask, I think it's obvious. President Trump is a reviled figure in the audience that Austan is aiming his video at. So personalizing it, wrapping policy up in Trump's personality, loading the actions of our complex political system into the actions of one person, though it manifestly is nothing of the sort, serves an obvious rhetorical purpose. Hate Trump, hate the plan. It is the first of many dog-whistles.

"Scam" is the single most interesting word.

But I am giving Austan too much credit to treat this as an interesting or original rhetorical device. You've heard "tax scam" before, I presume. "#GOPtaxscam" was right there on a big billboard in front of Nancy Pelosi as she denounced the bill. It's already a hashtag Her official website starts with

(I would be curious to find the source and history of the phrase. But I'm not patient enough at google searching to do it.)

So this is not clever Austan rhetoric. Austan is repeating a well-orchestrated bit of democratic party spin, talking point, or propaganda. It's the second dog-whistle.

Political parties do this. They search for some phrase that catches the ear. They aim primarily to marshal moral outrage and demonize the political opposition. Hence "scam" not "distorted incentives" or "misplaced priorties" [growth vs. redistribution]. The phrases are fairly meaningless. But if you repeat them over and over again, they start to get meaning and energize the base.

Really, Austan? Is this the best you can do? Is the role of public intellectuals and "real economists" to assert their intellectual superiority by their credentials, and then to repeat whatever buzzword their chosen political party is pushing these days, be it "tax cuts for the rich" "make america great again" or ,"tax scam?"

"Tax scam" is particularly loathsome for an honest intellectual as it is useful as partisan rhetoric. It does not appeal to any actual analysis of the tax code, or the troublesome fact that Obama himself wanted to cut corporate taxes, and ran a few dollars of deficit along the way. Instead it just attacks the motivations of the other side. And then people like Austan complain of partisanship.

"Trickle down" is another dog-whistle calumny, another bit of rhetorical propaganda, another deliberate placing of evil words in an opponent's mouth, another big lie (let's be frank about it) that Austan and company hope that by passing around over and over again will become truth.

I would be very interested to see any quote from anyone who worked on this tax bill advocating that it will work by "trickle down." The argument for it is that it works by incentives. A better prospective rate of return gives companies a better reason to invest. Period. "Trickle down" is a pejorative version of Keynesian economics, not of incentive economics. It was invented by critics of tax reform.

Austan has plenty of company. Larry Summers*, usually excellent at offering actual economic analysis in defense of democratic party causes, seems to have lost his bearings. After eight years of very influential commentary that the economy is in "secular stagnation" and requires massive deficit financed government spending, after complaining that the roughly $10 trillion added to the national debt during the Obama years was inadequate, Larry now proclaims in a Washington Post oped that the economy is on a "sugar high," and that the prospective $1.5 trillion in additional debt over the next 10 years

Alan Blinder, in an amazingly weak attack on the tax bill in the WSJ did a better job. Why do I say weak? Tot up Alan's arguments: 1) Republican senators and representatives overdid their back-slapping and Trump-congratulation at the signing ceremony. 2) Trump was wrong to claim it's the biggest cut in history. Reagan and Bush were bigger. 3) The new tax bill, like the old one, is full of special provisions and deductions. 4) The personal tax cuts expire, to fill budget rules, unless congress extends them. 5) it raises the deficit 6) The process wasn't open enough 7) a revenue neutral, distribution-neutral, broaden the base, cut the rates reform like 1986 -- and like the one Paul Ryan started out with before it went through the congressional sausage machine -- would have been better.

Alan repeated the "trickle down" calumny, and like Larry his concern about the deficit is a bit of a sudden conversion. But other than that, he makes a good honest effort with a weak hand. I agree with 3 and 7, and don't think it's my job to comment on 1, 2, 4, and 6. But that it could have been better seems a weak argument for throw it all out.

**********

This all builds up to some positive thoughts. What is a good role for policy-engaged economists, or even economists who want to transcend institutional boundaries and become public intellectuals? What are some useful rules to follow?

Usually, "actual economics" finds little of value in either political party's propaganda. Echoing that propaganda is a sure sign of empty analysis, so avoid it.

Actual policy is usually a very messy political compromise of any clear economic vision. Peggy Noonan had, I think, the right attitude in last Saturday's Wall Street Journal:

Actual economics is most delightful because it offers answers outside of the usual morality play. Focus on incentives, not who gets what out of the tax code. Point out the missing budget constraint. Notice that the behavior you deplore is a rational response to a misguided incentive, not a sign of evil.

Politics thrives on demonization. But it is a fact, which people who have tasted Washington like Summers and Goolsbee have done should know better than the rest of us, that the vast majority of people in public life are good people, and have the same goals. Democrats and Republicans, even many from the outer fringes of the parties, fundamentally want a better life for all Americans, and prioritize those in tough circumstances more than others. They disagree, and deeply, about cause and effect mechanisms to reach that common goal. It is not good politics to point this out, nor good for advancing one's particular solution to a problem through the political process. But it is much better policy analysis, and much better scholarship to acknowledge the truth.

Don't play politician. You're trained to be an economist, not a politician. Ed Lazear tells a good story of once offering political advice to President Bush, and being quickly shut down. Bush told him to give the best possible economic analysis and leave the politics to Bush.

Now, one can make some room for economists actually working in the government. A treasury secretary must, once the internal give and take is over, sell the imperfect product. But that can mostly be done with creative silence, and does not extend to parroting propaganda. Economists who used to work in government, and presumably wish to return also must to some extent show they are part of the team. But articulate, analytical and a bit one-sided support need not dip to propaganda and demonization. And our political system could do with a little more self-restraint, politeness, abstention from calumnies and demonization too.

Obviously, bending over backwards to point out deficiencies on both sides of the partisan divide, and good things on the other side, when one can, is useful to establish some credibility.

Doing otherwise also further tarnishes the brand name of economics, and academia, and science in general. When Austan wraps his political dog-whistles in "I'm an Actual Economist" and shows his PhD, honest citizens don't so much update the deep truth of democratic party propaganda, they update on what academic credentials mean, and what academic research and analysis is. No, 99% of us are not here to scream one party's talking points are the utter truth, and the others scheming evildoers.

It does more than tarnish some vague reputation of "actual economists" (I may be kidding myself that we have much!) Austan's employer is a non-partisan, non-profit, explicitly forbidden to engage in political activity as a condition of receiving tax-deductible gifts, to operate as a non-profit, and to receive federal funds. The reputation if not the tax status of academia is in question. Universities are widely perceived, and not altogether incorrectly, as hotbeds of partisan political activism. Congress is waking up, and the tax bill also started to rein in our privileges.

While faculty are entitled to our opinions, and to express them, and to engage as private citizens in political activity, and to speak as we wish, when we drag our professions in, the response is natural. If Austan had merely started "Hi, I'm an actual ex-Democratic administration official, hopeful to get a new and better job in the next Democratic presidency, and ..." I would have little objection at all.

Ad-hominem attacks, attacks on an an intellectual opponent's motivation, especially with no documented evidence at all for that attack, used to be strictly out of bounds for "actual economists," and scholars in general.

In fact, productive discussion is usually enhanced when one ignores motivations that are there and documentable. It's better to win on logic and fact and ignore motivation. Contrariwise, when you see an argument by motivation, which Austan made three times in as many sentences, you should infer that the arguer has neither fact nor logic to offer.

That agreement not to impugn motives is the only hope for a productive conversation, either in academia or in politics. Once you say "scam," that's over.

Update:

Austan responds with class:

In person, Austan has always been an exemplary person to debate public policy with. He supports his arguments with logic and fact, and displays a deep command of the economics literature. "Now wait a minute there John, there was this study in the QJE last year that showed...." and I would have to humbly say "Hmm, I'll have to read that." Unlike many other economists, he never shot back easy talking points, party propaganda, or arguments by motives. In part, I guess, the contrast between the private and public Austan got me so grumpy in this post. I don't bother to criticize Paul Krugman or Brad DeLong for far worse sins.

*Update 2:

Larry Summers writes, objecting to my statement "advocate for democratic party causes." Larry points, correctly, to his support for Glass Stegall repeal, his efforts to reform GSEs, his support for the Keystone pipeline, tort reform, regulatory streamlining, against single payer health insurance, and for trade agreements. I add that Larry has suffered pretty harsh criticism from people in the democratic party for these positions.

Austan:

"Hi, I'm an actual economist (MIT PhD degree shown)

and I promise you

Donald Trump's tax plan is a scam. ...

This tax cut was designed to help Johnny Marshmallow (Billionaire, with monopoly man image) ...

President Trump believes that if you give more money to big corporations and billionaires that money will trickle down to you..."

Let us analyze the rhetoric of these amazing sentences carefully.

"I'm an actual economist (MIT PhD degree shown)"This is an argument by authority, by credentialism. He, Austan, has a PhD from a Big Name institution. What follows is therefore a result of that special knowledge, that special insight, that special training, that actual economists have. He doesn't have to offer logic or fact, which you won't understand, and you aren't allowed to argue back with logic or fact, unless perhaps you too have a Big Name PhD. What follows isn't just going to be Austan's personal opinions, it inherits the aura of the whole discipline. By implication, anyone who disagrees isn't an "actual economist."

"Donald Trump's tax plan is a scam"This are the most interesting 7 words.

It is not, in fact, "Donald Trump's" tax plan. It is, clearly, a tax plan hashed out by Republicans in Congress, with some input from the administration, mostly the Treasury department. Almost nothing in this comes form Donald Trump. Just how many nights was President Trump up late on his laptop sweating over the income and depreciation limits of pass-through income deductions? Not many, I'd wager. So why is Austan calling it "Donald Trump's tax plan," not (say) "Congressional Republican's tax plan?"

Once you ask, I think it's obvious. President Trump is a reviled figure in the audience that Austan is aiming his video at. So personalizing it, wrapping policy up in Trump's personality, loading the actions of our complex political system into the actions of one person, though it manifestly is nothing of the sort, serves an obvious rhetorical purpose. Hate Trump, hate the plan. It is the first of many dog-whistles.

"Scam" is the single most interesting word.

"scam." noun. informal

1. a dishonest scheme; a fraud. "an insurance scam."

synonyms: fraud, swindle, fraudulent scheme, racket, trick; pharming; informalcon, hustle, flimflam, bunco, grift, gyp, shakedown. "the scam involved a series of bogus investment deals"

(-Google dictionary)Now, detecting "scams" is not the sort of thing that Real Economists are trained to do. We can analyze incentive effects and distribution tables, spot budget constraints, and argue over deficits and economic growth effects. But "scam" is an accusation that the intentions of those writing the tax bill are malign. Just how does Herr Prof. Dr. Austan Goolsbee, "real economist," know anything at all about the intentions behind the tax bill? To say nothing of (now that he personalized it) Donald Trump's intentions?

But I am giving Austan too much credit to treat this as an interesting or original rhetorical device. You've heard "tax scam" before, I presume. "#GOPtaxscam" was right there on a big billboard in front of Nancy Pelosi as she denounced the bill. It's already a hashtag Her official website starts with

“Today, President Trump signed into a law a GOP tax scam...A quick google search reveals a whole website devoted to "GOP tax scam," and its many echoes in the political media.

(I would be curious to find the source and history of the phrase. But I'm not patient enough at google searching to do it.)

Political parties do this. They search for some phrase that catches the ear. They aim primarily to marshal moral outrage and demonize the political opposition. Hence "scam" not "distorted incentives" or "misplaced priorties" [growth vs. redistribution]. The phrases are fairly meaningless. But if you repeat them over and over again, they start to get meaning and energize the base.

Really, Austan? Is this the best you can do? Is the role of public intellectuals and "real economists" to assert their intellectual superiority by their credentials, and then to repeat whatever buzzword their chosen political party is pushing these days, be it "tax cuts for the rich" "make america great again" or ,"tax scam?"

"Tax scam" is particularly loathsome for an honest intellectual as it is useful as partisan rhetoric. It does not appeal to any actual analysis of the tax code, or the troublesome fact that Obama himself wanted to cut corporate taxes, and ran a few dollars of deficit along the way. Instead it just attacks the motivations of the other side. And then people like Austan complain of partisanship.

"This tax cut was designed to help Johnny Marshmallow" (Billionaire, with monopoly man image)"This is a flat out ... untruth. I'm trying to be polite. Perhaps Austan's analysis of the general equilibrium burden of taxation reveals that in the end Johnny Marshmallow gets a better deal out of it than Joe Working Stiff. But it is simply untrue that the tax cut was designed to that purpose. The clear design was to lower the cost of capital, thereby increase investment, and thereby raise productivity and wages. This is the clear public statements of the designers. We can argue whether it will work as designed. But if you're going to attack motivations you have to deal with the constantly repeated statements of the designers, and the absence of any evidence for the contrary view. "Real Economists" have no special training in journalistic or historical analysis, for assembling evidence on intentions. And it shows.

"President Trump believes that if you give more money to big corporations and billionaires that money will trickle down to you..."Again, here is a statement of a fact, by a PhD academic, with not a whiff of evidence. Just where in the MIT PhD program do they train you to make statements of fact with no evidence? How does Austan know what President Trump "believes?"

"Trickle down" is another dog-whistle calumny, another bit of rhetorical propaganda, another deliberate placing of evil words in an opponent's mouth, another big lie (let's be frank about it) that Austan and company hope that by passing around over and over again will become truth.

I would be very interested to see any quote from anyone who worked on this tax bill advocating that it will work by "trickle down." The argument for it is that it works by incentives. A better prospective rate of return gives companies a better reason to invest. Period. "Trickle down" is a pejorative version of Keynesian economics, not of incentive economics. It was invented by critics of tax reform.

Austan has plenty of company. Larry Summers*, usually excellent at offering actual economic analysis in defense of democratic party causes, seems to have lost his bearings. After eight years of very influential commentary that the economy is in "secular stagnation" and requires massive deficit financed government spending, after complaining that the roughly $10 trillion added to the national debt during the Obama years was inadequate, Larry now proclaims in a Washington Post oped that the economy is on a "sugar high," and that the prospective $1.5 trillion in additional debt over the next 10 years

will also mean higher deficits and capital costs, it will likely crowd out as much private investment as it stimulates.

His "10,000 people will die!" attracted a lot of attention.

Perhaps something about Trump's style causes people to become unhinged. But it does not escape notice when economic analysis changes sharply the minute after an election, and I think Larry lost a lot of his reputation for economics-based analysis.

Alan Blinder, in an amazingly weak attack on the tax bill in the WSJ did a better job. Why do I say weak? Tot up Alan's arguments: 1) Republican senators and representatives overdid their back-slapping and Trump-congratulation at the signing ceremony. 2) Trump was wrong to claim it's the biggest cut in history. Reagan and Bush were bigger. 3) The new tax bill, like the old one, is full of special provisions and deductions. 4) The personal tax cuts expire, to fill budget rules, unless congress extends them. 5) it raises the deficit 6) The process wasn't open enough 7) a revenue neutral, distribution-neutral, broaden the base, cut the rates reform like 1986 -- and like the one Paul Ryan started out with before it went through the congressional sausage machine -- would have been better.

Alan repeated the "trickle down" calumny, and like Larry his concern about the deficit is a bit of a sudden conversion. But other than that, he makes a good honest effort with a weak hand. I agree with 3 and 7, and don't think it's my job to comment on 1, 2, 4, and 6. But that it could have been better seems a weak argument for throw it all out.

**********

This all builds up to some positive thoughts. What is a good role for policy-engaged economists, or even economists who want to transcend institutional boundaries and become public intellectuals? What are some useful rules to follow?

Usually, "actual economics" finds little of value in either political party's propaganda. Echoing that propaganda is a sure sign of empty analysis, so avoid it.

Actual policy is usually a very messy political compromise of any clear economic vision. Peggy Noonan had, I think, the right attitude in last Saturday's Wall Street Journal:

The fair way to judge the tax bill was never through the mindless, whacked-out rhetoric on both sides—the worst bill in the history of the world, the best thing since Coolidge was a pup—but through the answer to one question: Will this bill make things a little better or a little worse?..."mindless whacked-out rhetoric" is spot on -- and a spot on characterization of what Austan offered in place of actual economics. A little better or a little worse is a good frame for analyzing any policy proposal.

Actual economics is most delightful because it offers answers outside of the usual morality play. Focus on incentives, not who gets what out of the tax code. Point out the missing budget constraint. Notice that the behavior you deplore is a rational response to a misguided incentive, not a sign of evil.

Politics thrives on demonization. But it is a fact, which people who have tasted Washington like Summers and Goolsbee have done should know better than the rest of us, that the vast majority of people in public life are good people, and have the same goals. Democrats and Republicans, even many from the outer fringes of the parties, fundamentally want a better life for all Americans, and prioritize those in tough circumstances more than others. They disagree, and deeply, about cause and effect mechanisms to reach that common goal. It is not good politics to point this out, nor good for advancing one's particular solution to a problem through the political process. But it is much better policy analysis, and much better scholarship to acknowledge the truth.

Don't play politician. You're trained to be an economist, not a politician. Ed Lazear tells a good story of once offering political advice to President Bush, and being quickly shut down. Bush told him to give the best possible economic analysis and leave the politics to Bush.

Now, one can make some room for economists actually working in the government. A treasury secretary must, once the internal give and take is over, sell the imperfect product. But that can mostly be done with creative silence, and does not extend to parroting propaganda. Economists who used to work in government, and presumably wish to return also must to some extent show they are part of the team. But articulate, analytical and a bit one-sided support need not dip to propaganda and demonization. And our political system could do with a little more self-restraint, politeness, abstention from calumnies and demonization too.

Obviously, bending over backwards to point out deficiencies on both sides of the partisan divide, and good things on the other side, when one can, is useful to establish some credibility.

Doing otherwise also further tarnishes the brand name of economics, and academia, and science in general. When Austan wraps his political dog-whistles in "I'm an Actual Economist" and shows his PhD, honest citizens don't so much update the deep truth of democratic party propaganda, they update on what academic credentials mean, and what academic research and analysis is. No, 99% of us are not here to scream one party's talking points are the utter truth, and the others scheming evildoers.

It does more than tarnish some vague reputation of "actual economists" (I may be kidding myself that we have much!) Austan's employer is a non-partisan, non-profit, explicitly forbidden to engage in political activity as a condition of receiving tax-deductible gifts, to operate as a non-profit, and to receive federal funds. The reputation if not the tax status of academia is in question. Universities are widely perceived, and not altogether incorrectly, as hotbeds of partisan political activism. Congress is waking up, and the tax bill also started to rein in our privileges.

While faculty are entitled to our opinions, and to express them, and to engage as private citizens in political activity, and to speak as we wish, when we drag our professions in, the response is natural. If Austan had merely started "Hi, I'm an actual ex-Democratic administration official, hopeful to get a new and better job in the next Democratic presidency, and ..." I would have little objection at all.

Ad-hominem attacks, attacks on an an intellectual opponent's motivation, especially with no documented evidence at all for that attack, used to be strictly out of bounds for "actual economists," and scholars in general.

In fact, productive discussion is usually enhanced when one ignores motivations that are there and documentable. It's better to win on logic and fact and ignore motivation. Contrariwise, when you see an argument by motivation, which Austan made three times in as many sentences, you should infer that the arguer has neither fact nor logic to offer.

That agreement not to impugn motives is the only hope for a productive conversation, either in academia or in politics. Once you say "scam," that's over.

Update:

Austan responds with class:

In person, Austan has always been an exemplary person to debate public policy with. He supports his arguments with logic and fact, and displays a deep command of the economics literature. "Now wait a minute there John, there was this study in the QJE last year that showed...." and I would have to humbly say "Hmm, I'll have to read that." Unlike many other economists, he never shot back easy talking points, party propaganda, or arguments by motives. In part, I guess, the contrast between the private and public Austan got me so grumpy in this post. I don't bother to criticize Paul Krugman or Brad DeLong for far worse sins.

*Update 2:

Larry Summers writes, objecting to my statement "advocate for democratic party causes." Larry points, correctly, to his support for Glass Stegall repeal, his efforts to reform GSEs, his support for the Keystone pipeline, tort reform, regulatory streamlining, against single payer health insurance, and for trade agreements. I add that Larry has suffered pretty harsh criticism from people in the democratic party for these positions.

Mankiw on endowment taxes

Greg Mankiw wrote a New York Times column December 24 criticizing the university endowment tax. I disagree, not so much with the wisdom of the tax, but with the wisdom of writing such an article.

The tax is small -- 1.4% of endowment income. So if $100 of endowment earns 10%, or $10 of income, the university pays 14 cents. Still, with $38 billion of endowment like Harvard's, or $22 billion like Stanford's that adds up to some real money.

Greg writes that it is "hard to justify this policy." Universities invest in "human capital, which means educating our labor force" and "the knowledge that flows from basic research." Mainly, though, Greg's against the tax because the few elite universities with more than $500,000 endowment per student, (unlike the community colleges and state schools that actually do train the labor force)

Lower rates, broaden base?

Does not every claimant on the public purse, anxious to preserve a tax deduction, claim that they provide a public good? The home builders, the mortgage bankers, and the real estate agents went apoplectic over limiting the deductibility of home mortgage interest. Because it was going to destroy the American Dream of Homeownership. Because building home equity is the tried and true, well, "engine of economic growth for the middle class!" Farmers demand agricultural subsidies to defend their storied way of life. Why, without the Family Farm, the fabric of American society is lost! The bankers demand immense leverage, deductibility of corporate interest, and a range of anti-competitive regulation because otherwise, who will lend to the middle class! The solar cell and electric car manufacturers want tax credits and subsidies because they're saving the planet. And on we go.

Conservative, "Republican," free-market principles used to be to advocate for lower marginal tax rates, and a broader base, in which everyone gives up their little deduction or subsidy. (I use "Republican" as Greg uses it, so don't go all nuts in the comments about Republican failings to live up to these ideals.)

How can we credibly proclaim that we, universities, provide the true public good and deserve subsidies, but the rest of you get lost? Do we not look just a little hypocritical if when a tax reform is announced, we jump in line with the rest of them to demand our pork back?

Greg started his oped well:

Should not the role of a renown economist, public intellectual, like Greg, to be to explain lower the rates broaden the base from the rooftops -- and when the time comes, to say that yes, we will give up our subsidies, and we will in doing so lead the fight for everyone to give up theirs too?

Yes, this is a tiny tax, in a bill that only begins to cut deductions. But if there is any hope for reform, our time will come. If we want to lower rates and broaden the base, we will have to cut the holy trinity -- employer health care, charitable, and mortgage interest. While there are many worthy charities and nonprofits, including both Greg's and my employers, charitable deductions and nonprofits have become a cesspool of tax shenanigans and politics. When the time comes that a real cut is on the table, will we say, "yes, we accept ours too," or will we run to Washington to plead "everyone else yes, but spare us?"

How to subsidize

Moreover, if indeed universities provide useful public goods -- and they do, and I include low tuition for low-income students and basic research -- surely how that activity is subsidized matters. There are good and bad ways to subsidize anything. That is a second "principle" of good conservative, "Republican" and free-market governance.

Usually, giving a lot of money to a large opaque and competition-protected bureaucratic institution that does a lot of things, to spend as it wishes, does not produce the outcome you want. Usually, funding that subsidy by giving a franchise such as a little monopoly or the unique opportunity to run a tax-shielded hedge fund does not produce the outcome you want.

When you want a public good from such institutions, conservative principles usually suggest that the subsidy be transparent, annually appropriated, reviewed, and given for the activity you want. Give federal scholarships to the students, chosen by federal rules, and studying things that taxpayer representatives find useful. Support research through competitive grants. Perfect? No. But a lot better than counting on tax-subsidized endowment profits to go where you want them to go.

Otherwise, you tend to get big administrative bureaucracies, sports and recreation programs, bloated faculties with high salaries, low teaching loads and a lot of silly research, and a few crumbs to the worthy students. You also get admissions offices selecting students by all sorts of crazy criteria suiting the admissions office, including some rather stunning obstacles to asian-Americans. If the taxpayers are footing the bill -- and they are here -- shouldn't they get some say in who gets the goodies and what they do with them?

So, if sending low-income students to Harvard and Princeton is a good idea, conservative, "Republican" and free market principles direct us to argue for a direct, budgeted subsidy, not a hidden special opportunity to run tax-advantaged hedge funds on the hope universities will spend the profits in some publicly useful way.

Just in time, the WSJ "notable and quotable" which seems to be running a series on abstract abstracts from academic journals ran a good one. From the original source, Stephanie Springgay writing in the journal Research in Eduction,

Really, Greg? Taxpayers should support more of this "basic research?" (Yes, argument by anecdote is unfair, but this is a blog, and we're having fun.) Is this not an example of what happens when you hope that public goods are supported by an obscure wealth transfer, rather than on-budget spending? (Again, there are plenty of horror stories at the NSF too, but at least they are transparently linked to the subsidy.)

More

Greg does not question why such universities charge tuition ($43,450 at Princeton) in the first place, then pat themselves on the back for using endowment payouts to pay themselves this tuition for favored students. Nor does he discuss the incentives that income-based and asset-based financial aid leads to. Greg is usually on top of marginal tax rates. (Hint, if you're anywhere near this income class, with a kid that can get in, working harder or saving a few pennies for college will cost you dollar for dollar in less aid.) Greg calls such "well-endowed universities "engines of economic growth for the middle class." Greg does not address what fraction of "middle class" students are admitted to Harvard, Princeton, Yale, Stanford or other universities with half a million per student endowment. Is it 0.001%? Community colleges are the engines of economic growth for the middle class.

Greg notices that some of this tax may be blowback for the uniform partisan sympathies of major research universities.

Greg also writes

Greg is, I think, right that this some of the endowment tax is blowback. If conservatives remain in charge in Washington, and universities keep going as they are now, it may only be the beginning.

The tax is small -- 1.4% of endowment income. So if $100 of endowment earns 10%, or $10 of income, the university pays 14 cents. Still, with $38 billion of endowment like Harvard's, or $22 billion like Stanford's that adds up to some real money.

Greg writes that it is "hard to justify this policy." Universities invest in "human capital, which means educating our labor force" and "the knowledge that flows from basic research." Mainly, though, Greg's against the tax because the few elite universities with more than $500,000 endowment per student, (unlike the community colleges and state schools that actually do train the labor force)

"use their resources [to offer] need-blind, full-need admissions...."

"At Princeton [$24 billion] about 60 percent of undergraduates get financial aid. This aid covers the entire cost of tuition, room and board for students from families with income below $65,000 a year."In sum, Greg feels that universities provide a public good, of refraining from charging tuition for low-income students, so should retain this subsidy. And subsidy it is. While I think all capital taxes should be zero for everyone, given that everyone else pays capital taxes, the fact that universities can borrow at tax-free rates, accept tax-exempt gifts, put the money into endowments which are run like funds-of-funds, hiring high-priced managers to send money to high-priced managers of hedge funds, private equity, venture capital, and real estate, and pay no tax on dividends, interest, capital gains, ever, amounts to quite a subsidy relative to everyone else. And it comes out of taxes that universities do not pay, which means everyone else pays more.

Lower rates, broaden base?

Does not every claimant on the public purse, anxious to preserve a tax deduction, claim that they provide a public good? The home builders, the mortgage bankers, and the real estate agents went apoplectic over limiting the deductibility of home mortgage interest. Because it was going to destroy the American Dream of Homeownership. Because building home equity is the tried and true, well, "engine of economic growth for the middle class!" Farmers demand agricultural subsidies to defend their storied way of life. Why, without the Family Farm, the fabric of American society is lost! The bankers demand immense leverage, deductibility of corporate interest, and a range of anti-competitive regulation because otherwise, who will lend to the middle class! The solar cell and electric car manufacturers want tax credits and subsidies because they're saving the planet. And on we go.

Conservative, "Republican," free-market principles used to be to advocate for lower marginal tax rates, and a broader base, in which everyone gives up their little deduction or subsidy. (I use "Republican" as Greg uses it, so don't go all nuts in the comments about Republican failings to live up to these ideals.)

How can we credibly proclaim that we, universities, provide the true public good and deserve subsidies, but the rest of you get lost? Do we not look just a little hypocritical if when a tax reform is announced, we jump in line with the rest of them to demand our pork back?

Greg started his oped well:

"The tax legislation approved last week by Congress....combines some badly needed reforms with various messy provisions seemingly designed to keep accountants and tax lawyers fully employed."The reason it ended up that way is that the minute it was announced, every Tom, Dick, Harry, Susan, and Jane rushed to Washington to protest losing their deductions and credits, and given that passage relied on reconciliation rules, no democrats and a tiny margin in the senate, Congress caved in quickly. The hope to lower marginal rates and broaden the base got swiftly rolled back. (There is some progress -- state and local and mortgage deductions are limited. But a lot less than we have hoped for these last 31 years.)

Should not the role of a renown economist, public intellectual, like Greg, to be to explain lower the rates broaden the base from the rooftops -- and when the time comes, to say that yes, we will give up our subsidies, and we will in doing so lead the fight for everyone to give up theirs too?

Yes, this is a tiny tax, in a bill that only begins to cut deductions. But if there is any hope for reform, our time will come. If we want to lower rates and broaden the base, we will have to cut the holy trinity -- employer health care, charitable, and mortgage interest. While there are many worthy charities and nonprofits, including both Greg's and my employers, charitable deductions and nonprofits have become a cesspool of tax shenanigans and politics. When the time comes that a real cut is on the table, will we say, "yes, we accept ours too," or will we run to Washington to plead "everyone else yes, but spare us?"

How to subsidize

Moreover, if indeed universities provide useful public goods -- and they do, and I include low tuition for low-income students and basic research -- surely how that activity is subsidized matters. There are good and bad ways to subsidize anything. That is a second "principle" of good conservative, "Republican" and free-market governance.

Usually, giving a lot of money to a large opaque and competition-protected bureaucratic institution that does a lot of things, to spend as it wishes, does not produce the outcome you want. Usually, funding that subsidy by giving a franchise such as a little monopoly or the unique opportunity to run a tax-shielded hedge fund does not produce the outcome you want.

When you want a public good from such institutions, conservative principles usually suggest that the subsidy be transparent, annually appropriated, reviewed, and given for the activity you want. Give federal scholarships to the students, chosen by federal rules, and studying things that taxpayer representatives find useful. Support research through competitive grants. Perfect? No. But a lot better than counting on tax-subsidized endowment profits to go where you want them to go.

Otherwise, you tend to get big administrative bureaucracies, sports and recreation programs, bloated faculties with high salaries, low teaching loads and a lot of silly research, and a few crumbs to the worthy students. You also get admissions offices selecting students by all sorts of crazy criteria suiting the admissions office, including some rather stunning obstacles to asian-Americans. If the taxpayers are footing the bill -- and they are here -- shouldn't they get some say in who gets the goodies and what they do with them?

So, if sending low-income students to Harvard and Princeton is a good idea, conservative, "Republican" and free market principles direct us to argue for a direct, budgeted subsidy, not a hidden special opportunity to run tax-advantaged hedge funds on the hope universities will spend the profits in some publicly useful way.

Just in time, the WSJ "notable and quotable" which seems to be running a series on abstract abstracts from academic journals ran a good one. From the original source, Stephanie Springgay writing in the journal Research in Eduction,

The idea that the world is composed of moving and constantly transforming materialities that are vibrant, quivering, and indeterminate has shifted how we think about human and non-human relations. Matter is not a stable entity, but one that is continuously vibrating and differentiating. This materialism is crucial for thinking about possible futures of educational research. In this paper, I turn to the materiality of rhythm, movement, and affect to suggest a more vital understanding of participation and thus politics...It goes on like this.

Really, Greg? Taxpayers should support more of this "basic research?" (Yes, argument by anecdote is unfair, but this is a blog, and we're having fun.) Is this not an example of what happens when you hope that public goods are supported by an obscure wealth transfer, rather than on-budget spending? (Again, there are plenty of horror stories at the NSF too, but at least they are transparently linked to the subsidy.)

More

Greg does not question why such universities charge tuition ($43,450 at Princeton) in the first place, then pat themselves on the back for using endowment payouts to pay themselves this tuition for favored students. Nor does he discuss the incentives that income-based and asset-based financial aid leads to. Greg is usually on top of marginal tax rates. (Hint, if you're anywhere near this income class, with a kid that can get in, working harder or saving a few pennies for college will cost you dollar for dollar in less aid.) Greg calls such "well-endowed universities "engines of economic growth for the middle class." Greg does not address what fraction of "middle class" students are admitted to Harvard, Princeton, Yale, Stanford or other universities with half a million per student endowment. Is it 0.001%? Community colleges are the engines of economic growth for the middle class.

After the excellent first sentence, above, Greg writes

"the part of the bill that most disappoints me is.. a new tax on large university endowments. "

(my emphasis.) I can think of a few greater disappointments! (And, to be fair, hopes for future reforms if this is successful. They did limit mortgage interest. So it's just a low voltage plug, not a third rail.)

Greg notices that some of this tax may be blowback for the uniform partisan sympathies of major research universities.

"Senartor Kennedy then said 'and they're from Harvard. For all I know they are a bunch of weenie liberals. Probably were if they're from Harvard.'"Greg points out that Senator Kennedy was wrong in this case, as he was referring to Robert Barro, But the Senator was right on conditional probability. Beyond Greg, Barro, and Feldstein just how many self-identified Republicans are there at Harvard?

Greg also writes

"Most professors leave their ideology at the door when they teach the next generation of leaders"That isn't even true in economics, and a wispy dream in the humanities. (For an example, just see my next post.)

Greg is, I think, right that this some of the endowment tax is blowback. If conservatives remain in charge in Washington, and universities keep going as they are now, it may only be the beginning.

IRC Irish Research Funding 2018 Indicative Call Schedule

Posted by Economist Channel on

Label:

See this link for the 2018 indicative call schedule for research funding of the main research funding body in Ireland. This includes calls for PhD studentships, postdoctoral fellowships, industry/policy collaborations, and principal investigator led research funding. I am happy to discuss collaboration or hosting in the broad areas of interest in our research group across these funding areas.

Response to Williamson on taxes

Steve Williamson has an interesting new post on corporate taxes and investment, in which he claims that taxing corporate profits has no effect on investment.

The answer is in a previous post on the burden of taxation, and Greg Mankiw's algebra but at the cost of repeating let's isolate the central issue. (The previous posts were too long, for sure.)

If you want equations, go back to Greg Mankiw's algebra. There you see a model in which corporate taxes do distort the intertemporal incentive to invest.

The key difference: In his simple model, Greg defines profits as sales - wages. Then if the firm pays $100 to invest today, makes $10 out of it tomorrow after paying wages, but faces a 50% tax rate, it gets a 5% rate of return, while without a corporate tax it gets a 10% rate of return.

Steve defines profits as sales - wages - costs of investment. He effectively assumes that all investment is tax deductible. Then indeed a constant tax rate does not distort the rate of return. The firm gets the tax deduction on the investment made today, and that compensates for the lost profits tomorrow.

This is then the same argument that was floating around last time, (see posts for links) that full expensing of investment alone should solve the intertemporal distortions, and then tax capital at any rate you like including 99.999%.

What's the problem with that? Well, if you apply it completely, there is nothing left to tax. If a debt-financed firm can deduct from its sales all wages, inputs, investments, and interest payments, there is nothing left to tax.

The tax code seems to think payments to shareholders are "profits" which can be taxed without distortion and interest payments are "costs" like the electric bill that must be deducted. But there is no fundamental economic distinction between debt and equity as a marginal source of investment funds. Dividends (and capital gains) are the returns you must pay to attract equity investors, just as interest is the return you must pay to attract bond investors.

So how do you deduct investment and leave something left over to tax? It rests on two ideas. First, that the tax code can distinguish "real" investments like buying forklifts from "financial" investments like buying stocks and bonds, and only deduct the former.

Second, that there is some pure "profit," some pure "rent," some "unreproducible input" (i.e. something that did not come from a past unmeasured investment), something like the classic "unimproved land" that can be taxed, without distorting any decision. It goes hand in hand with the complaints of greater monopoly.

But I find it hard to find and name a concrete source of profits that, once named, does not distort the decision to undertake some useful activity to make those profits. Starting, organizing, and improving a business, figuring out the intangible organizational capital that makes it a successful competitor, creating a product and a brand name, are all crucial activities for which no investment tax credit will successfully offset a large profits tax. "Intangible capital" is about all most companies have these days.

Aside the investment distortion, I see an important political economy argument against corporate taxes. Corporations have a lot of money, and really good lawyers and lobbyists. The higher the corporate tax rate, the more they will run to Washington to demand special credits, exemptions, and deductions. Like expanded investment deductions. Already, the corporate tax was effectively about 20% rather than the statutory 35%. I can't see any defense other than a lower rate, and tax people rather than corporations.

Two final points of clarification.

First, Steve positioned his post as a response to my buyback fallacy post

Second, he writes

Steve didn't say otherwise, but you might have gotten the impression.

What happens if the corporate tax rate goes up permanently, with the tax rate constant forever...? This has no effect on investment or on the firm's hiring decisions in any period. That is, if VB is before tax profits, then (1-t)VB = V, so maximizing VB is the same as maximizing V, and the tax rate is irrelevant, not only for investment decisions, but for the firm's hiring decision. In the aggregate, there is no effect on labor demand, and therefore no effect on wages.

Basically, investment is an intertemporal decision for the firm. But the corporate tax rate affects per-period after-tax profits in exactly the same way in every period, so there is no effect on the after tax rate of return on investment the firm is facing. Therefore, the firm won't invest more with a lower corporate tax rate ...Steve concludes

But, the tax bill is not about investment. The primary effect is redistribution. In the short run, the tax bill makes the rich richer and the poor poorer...You can see there is a problem. If Steve is right, then why not a 99.999% capital tax rate? Per Steve, it won't distort any decisions, neither investment nor hiring nor starting companies, it will give a revenue bonanza for the government and it will transfer income efficiently. Surely if 99.999% corporate taxes had no disincentive effects, governments would have noticed? Surely not every single Republican is, as Steve implicitly charges, either lying through his teeth or an economic ignoramus when they state the goal of the tax cut is to spur investment, and thereby productivity and wages?

The answer is in a previous post on the burden of taxation, and Greg Mankiw's algebra but at the cost of repeating let's isolate the central issue. (The previous posts were too long, for sure.)

If you want equations, go back to Greg Mankiw's algebra. There you see a model in which corporate taxes do distort the intertemporal incentive to invest.

The key difference: In his simple model, Greg defines profits as sales - wages. Then if the firm pays $100 to invest today, makes $10 out of it tomorrow after paying wages, but faces a 50% tax rate, it gets a 5% rate of return, while without a corporate tax it gets a 10% rate of return.

Steve defines profits as sales - wages - costs of investment. He effectively assumes that all investment is tax deductible. Then indeed a constant tax rate does not distort the rate of return. The firm gets the tax deduction on the investment made today, and that compensates for the lost profits tomorrow.

This is then the same argument that was floating around last time, (see posts for links) that full expensing of investment alone should solve the intertemporal distortions, and then tax capital at any rate you like including 99.999%.

What's the problem with that? Well, if you apply it completely, there is nothing left to tax. If a debt-financed firm can deduct from its sales all wages, inputs, investments, and interest payments, there is nothing left to tax.

The tax code seems to think payments to shareholders are "profits" which can be taxed without distortion and interest payments are "costs" like the electric bill that must be deducted. But there is no fundamental economic distinction between debt and equity as a marginal source of investment funds. Dividends (and capital gains) are the returns you must pay to attract equity investors, just as interest is the return you must pay to attract bond investors.

So how do you deduct investment and leave something left over to tax? It rests on two ideas. First, that the tax code can distinguish "real" investments like buying forklifts from "financial" investments like buying stocks and bonds, and only deduct the former.

Second, that there is some pure "profit," some pure "rent," some "unreproducible input" (i.e. something that did not come from a past unmeasured investment), something like the classic "unimproved land" that can be taxed, without distorting any decision. It goes hand in hand with the complaints of greater monopoly.

But I find it hard to find and name a concrete source of profits that, once named, does not distort the decision to undertake some useful activity to make those profits. Starting, organizing, and improving a business, figuring out the intangible organizational capital that makes it a successful competitor, creating a product and a brand name, are all crucial activities for which no investment tax credit will successfully offset a large profits tax. "Intangible capital" is about all most companies have these days.

Aside the investment distortion, I see an important political economy argument against corporate taxes. Corporations have a lot of money, and really good lawyers and lobbyists. The higher the corporate tax rate, the more they will run to Washington to demand special credits, exemptions, and deductions. Like expanded investment deductions. Already, the corporate tax was effectively about 20% rather than the statutory 35%. I can't see any defense other than a lower rate, and tax people rather than corporations.

Two final points of clarification.

First, Steve positioned his post as a response to my buyback fallacy post

"Here's John Cochrane, writing about the 'buyback fallacy:'

'Many commenters on the tax bill repeat the worry that companies will just use tax savings to pay dividends or buy back shares rather than make new investments.'

But, John concludes:

'Investment will increase if the marginal, after-tax, return to investment increase...'"The second point, which we are discussing here, has absolutely nothing to do with the first point, the buyback fallacy. Whether corporate taxes do or do not distort investment decisions, buying back shares has nothing to do with it. The buyback fallacy remains a fallacy even if Steve is right and 99.99% corporate taxes have no effect on investment.

Second, he writes

this has no effect on investment or on the firm's hiring decisions in any period.Noone, not even Congressional Republicans, claimed that lowering capital taxes increases the incentive to hire directly. The reason is clear from the above -- in everyone's model, wage payments are deductible, profits = (sales - wages - ....), wages go inside the parentheses. The argument has always been that lowering corporate profits taxes increases the incentive to invest, and moreover to start new firms or reorganize them, that this investment would raise productivity, and that would lead to higher wages.

Steve didn't say otherwise, but you might have gotten the impression.

The Fiscal Theory of Monetary Policy

"Stepping on a Rake: the Fiscal Theory of Monetary Policy" is new paper, just published in the European Economic Review. This link gets you free access, but just for the next few days. After that, I can only post the last manuscript. (I held off sending this hoping the EER would fix the figure placement in the html version, but that didn't happen.)

The paper is about how the fiscal theory of the price level can describe monetary policy. Even without monetary, pricing, or financial frictions, the central bank can fix interest rates. In the presence of long-term debt higher interest rates lead to lower inflation for a while. Interest rate targets, forward guidance, and quantitative easing all work by the same mechanism. The paper also derives Chris Sims' "stepping on a rake" paper which makes that point, and integrates fiscal theory with a detailed new Keynesian model in continuous time.

The paper is about how the fiscal theory of the price level can describe monetary policy. Even without monetary, pricing, or financial frictions, the central bank can fix interest rates. In the presence of long-term debt higher interest rates lead to lower inflation for a while. Interest rate targets, forward guidance, and quantitative easing all work by the same mechanism. The paper also derives Chris Sims' "stepping on a rake" paper which makes that point, and integrates fiscal theory with a detailed new Keynesian model in continuous time.

The Buyback Fallacy

Posted by Economist Channel on

Tuesday, December 26, 2017

Label:

Commentary

,

Economists

,

Taxes

,

writing

Many commenters on the tax bill repeat the worry that companies will just use tax savings to pay dividends or buy back shares rather than make new investments.

Savannah Guthrie, interviewing Paul Ryan on the Today Show, thought she had a real gotcha with

Peggy Noonan, in an otherwise thoughtful column, echoed the same worry:

So, having established that this is a bipartisan worry, let's put the fallacy to bed. It is the fallacy of composition, that actions of one company mirror actions of the economy as a whole. It is the fallacy of "paper investments" vs. "real investments." That distinction can apply to a company, but not to the whole economy.

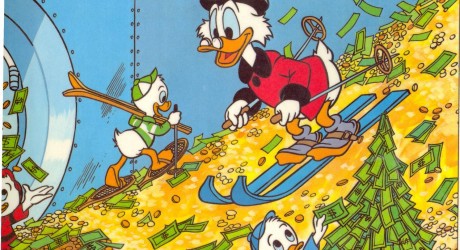

No, companies do not sit on vast swimming pools of gold coins, like Scrooge McDuck. One company's "cash" is a short term loan to another company, which the latter uses it to make real investments. Every asset (paper) is also a liability, backed by an investment. The charge fails to track the money. One of the few things economists know how to do is always to ask, "OK, and then what do they do with the money?" Money is a veil, and real decisions are (to first order) independent of financial decisions. (I use italics to suggest some ways to remember these basic economic ideas.)

Suppose company 1 gets a tax cut, doesn't really know what to do with the money -- on top of all the extra cash the company may already have -- as it doesn't have very good investment projects. It sends the money to shareholders. Well, what do shareholders do with it? (Hint: track the money.) They most likely roll the money in to other investments. They find company 2 that does need the money for investment, and send it to that company. In the end, they only consume it if nobody has any good investment ideas.

If company 1 doesn't have any good investment ideas, even after the tax cut, and company 2 does have some good investment ideas, made better after the tax cut, the economy needs to get money from company 1 to company 2. Company 1 could buy company 2; company 1 could invest in company 2 by buying its stock or buying its debt (all that "cash" you hear about); company 1 could return money to shareholders, and the shareholders could invest in company 2. They're all the same, to economics. Of all the ways to do this, actually, the last might well be the most efficient. Shareholders might have better ideas about good investments than managers of a company that doesn't have any good investment ideas.

The larger economic point: In the end, investment in the whole economy has nothing to do with the financial decisions of individual companies. Investment will increase if the marginal, after-tax, return to investment increases. Lowering the corporate tax rate operates on that marginal incentive to new investments. It does not operate by "giving companies cash" which they may use, individually, to buy new forklifts, or to send to investors. Thinking about the cash, and not the marginal incentive, is a central mistake. (It's a mistake endemic to Keynesian economics, but the case here is supply-side, incentive oriented.)

The point is the same as one I made in an earlier post, not to expect "repatriation" of corporate profits to make much difference to investment. Apple Ireland could already put money in a bank that lends to a US bank that lends to Apple US, if that money's best use was in the US. The marginal profitability of investment is all that matters.

Now, let me also quickly grant that there are second-order effects and frictions. Perhaps due to "agency costs," internally generated cash is a cheaper source of investment funds than cash obtained by issuing stock or borrowing. In that case, financing decisions do matter. Tracking down this sort of thing is what makes economics fun. But good economic analysis always starts with the relevant budget constraint or neutrality theorem, and then adds the frictions. Neither Ms. Guthrie nor Ms. Noonan had such a second order financing friction in mind.

Do not take this post as criticism of either author. They just happened to repeat the charge, which is floating around as part of the larger talking-point battle surrounding the tax cuts. Ms. Guthrie is an anchor trying to lob nasty questions, and Speaker Ryan could have answered this way. He chose a better answer in fact, recognizing that like "fantasy world" it was not a serious question. Ms. Noonan is a political commentator, and this minor fallacy does not detract from her interesting, larger, political point: Forget that returning cash to investors who quietly put it in better companies is economically efficient. If large companies are seen to just hand out presents to investors rather than to invest the funds internally, the political optics of the tax cut will be bad for its defenders. Sometimes paying attention to fallacies can be good P. R. It is, however, the job of economists as public intellectuals (subject of an upcoming post) to patiently point out this sort of thing, so maybe someday voters will not confuse P. R. stunts with progress.

Savannah Guthrie, interviewing Paul Ryan on the Today Show, thought she had a real gotcha with

"What they [CEOS] are planning to do is stock buybacks, to line the pockets of shareholders."(She then moved on to a question most guaranteed to produce retweets of partisan admirers, and least likely to produce an interesting answer,

"I'll ask you plainly, are you living in a fantasy world?"NBC then wonders that it is charged with partisan bias.)

Peggy Noonan, in an otherwise thoughtful column, echoed the same worry:

"Big corporations can take the gift of the tax cut ... and do superficial, pleasing public relations sort of things, while really focusing on buying back stock and upping shareholder profits."(Just how taking less of your money is a "gift" is a question for another day.)

So, having established that this is a bipartisan worry, let's put the fallacy to bed. It is the fallacy of composition, that actions of one company mirror actions of the economy as a whole. It is the fallacy of "paper investments" vs. "real investments." That distinction can apply to a company, but not to the whole economy.

|

| What corporate cash is not. |

Suppose company 1 gets a tax cut, doesn't really know what to do with the money -- on top of all the extra cash the company may already have -- as it doesn't have very good investment projects. It sends the money to shareholders. Well, what do shareholders do with it? (Hint: track the money.) They most likely roll the money in to other investments. They find company 2 that does need the money for investment, and send it to that company. In the end, they only consume it if nobody has any good investment ideas.

If company 1 doesn't have any good investment ideas, even after the tax cut, and company 2 does have some good investment ideas, made better after the tax cut, the economy needs to get money from company 1 to company 2. Company 1 could buy company 2; company 1 could invest in company 2 by buying its stock or buying its debt (all that "cash" you hear about); company 1 could return money to shareholders, and the shareholders could invest in company 2. They're all the same, to economics. Of all the ways to do this, actually, the last might well be the most efficient. Shareholders might have better ideas about good investments than managers of a company that doesn't have any good investment ideas.

The larger economic point: In the end, investment in the whole economy has nothing to do with the financial decisions of individual companies. Investment will increase if the marginal, after-tax, return to investment increases. Lowering the corporate tax rate operates on that marginal incentive to new investments. It does not operate by "giving companies cash" which they may use, individually, to buy new forklifts, or to send to investors. Thinking about the cash, and not the marginal incentive, is a central mistake. (It's a mistake endemic to Keynesian economics, but the case here is supply-side, incentive oriented.)

The point is the same as one I made in an earlier post, not to expect "repatriation" of corporate profits to make much difference to investment. Apple Ireland could already put money in a bank that lends to a US bank that lends to Apple US, if that money's best use was in the US. The marginal profitability of investment is all that matters.

Now, let me also quickly grant that there are second-order effects and frictions. Perhaps due to "agency costs," internally generated cash is a cheaper source of investment funds than cash obtained by issuing stock or borrowing. In that case, financing decisions do matter. Tracking down this sort of thing is what makes economics fun. But good economic analysis always starts with the relevant budget constraint or neutrality theorem, and then adds the frictions. Neither Ms. Guthrie nor Ms. Noonan had such a second order financing friction in mind.

Do not take this post as criticism of either author. They just happened to repeat the charge, which is floating around as part of the larger talking-point battle surrounding the tax cuts. Ms. Guthrie is an anchor trying to lob nasty questions, and Speaker Ryan could have answered this way. He chose a better answer in fact, recognizing that like "fantasy world" it was not a serious question. Ms. Noonan is a political commentator, and this minor fallacy does not detract from her interesting, larger, political point: Forget that returning cash to investors who quietly put it in better companies is economically efficient. If large companies are seen to just hand out presents to investors rather than to invest the funds internally, the political optics of the tax cut will be bad for its defenders. Sometimes paying attention to fallacies can be good P. R. It is, however, the job of economists as public intellectuals (subject of an upcoming post) to patiently point out this sort of thing, so maybe someday voters will not confuse P. R. stunts with progress.

The High Cost of Good Intentions

Posted by Economist Channel on

Friday, December 22, 2017

Label:

Commentary

,

Economists

,

Interesting Papers

,

Regulation

,

Social Programs

,

Taxes

The High Cost of Good Intentions is a superb new book by my Hoover colleague John Cogan. It is a political and budgetary history of U.S. Federal entitlement programs. It is full of lessons for just why the programs have expanded inexorably over time, and just how hard it will be for our political system to reform them.

If indeed the Congress will now turn to entitlement reform, as house speaker Paul Ryan has promised, this will be the book to have on your desk. (Ryan already blurbed it (back cover) as did Bill Bradley, Sam Nunn, George Shultz and Alan Greenspan.)

If you think entitlement programs, and the political hash that enacts them, are recent problems, or the fault of one political party, think again. John's main lesson is that the emergence of bloated entitlements is a hardy feature of our (and many other countries') democracies. He does this by just reading the history.

The habit of expanding entitlements started early. Chapter 2:

A bigger theme of the book is the politics of entitlements. That also starts long ago. Congressman Dudley Marvin of New York reports

There are occasional retrenchments and reforms, especially useful to ponder now.

*****

I'm up to the beginning, really, of the book, "The birth of the modern entitlement state." The centerpiece of the book is not these historical antecedents, but the political story of how the current US entitlements system evolved.

That story starts with the New Deal. It also brings in the judiciary, the "role of the federal courts in making public policy:"

One theme: Our government routinely liberalizes entitlements when budget surpluses are strong, and at least slows down their expansion in bad fiscal times. It also liberalizes entitlements in bad economic times.

That bears centrally on the current reform question. Our entitlements are, no surprise, on an unsustainable path. We will either reform them, in a way that reduces federal spending, or we will substantially raise taxes on the "middle class," including a large payroll tax increase and likely a european style VAT on top of growth-killing income and corporate taxes.

If one wishes for a reform on the expenditure side, the great question is whether it must be done directly or via "starving the beast" of tax revenue. For example, I advocate a VAT. A common complaint is that the VAT is not only a much more economically efficient way of raising a given revenue, it is a great way to raise much more revenue, and my critics complain it soon will do that and provoke even greater spending. The VAT shifts the top of the Laffer curve to the right, and in my critics' view, the US government will operate at the top of the long-run Laffer curve given structural limitations on its tax code.

I have held out hope that our democracy could contain itself to spend less than the top of the Laffer curve allows, so we can jettison the insane inefficiency and corruption of our tax code, and have one that is vastly more economically efficient. The opposite view really amounts to belief that democracy is fatally flawed. Moreover, I note that starve the beast tax reductions have led to massive deficit expansions, yet large debt and deficits have not yet seemed to provide much pressure against entitlement spending.

John's history is a strong push toward starve the beast, at least in the negative direction. Surpluses lead to benefit expansions, quickly.

Another theme: The accounting gimmicks such as "trust funds." Surpluses in trust funds lead to benefit expansions, even if there are huge deficits outside. And "trust fund" accounting gimmicks also go back a long way.

As we (hopefully) start to think about reform, I think the only hope is to break out of "we're spending too much there will be a debt crisis" vs. "you heartless evil person, just look at (deserving person). How can you throw her off the bus." The way to do that, I think, is to focus on the disincentives of our social programs, not on the cost or the worthiness of recipients. I find some comfort in John's history, that occasional retrenchments, including the above and the welfare reforms of the 1990s got through politically by looking at fraud (a form of disincentive) and other disincentives.

This is a history and a political history, not a reform proposal, nor an economic analysis of disincentives. Still, John's history is also full of quotes reflecting the centuries old tension in welfare programs between helping those in need and disincentives, which I'll cover in the next post. That history ought to help.

A note for graduate students: This book is very well written, and you should read it to emulate writing style as well as for the subject. No, it does not knock you over the head with beautiful sentences as John McPhee might. It is, however, beautifully structured. The whole book and each chapter starts with a complete summary of the argument, and the chapter fills it out. It could go on for thousands of pages, but manages to tell just enough of the story so you see the historical detail, but not enough so you get lost in what must been have fascinating historical detail. Yet this is not a standard quickie book aimed at a policy controversy. This is a deep piece of scholarship. Everything is footnoted -- 78 pages of footnotes and reference all together.

If indeed the Congress will now turn to entitlement reform, as house speaker Paul Ryan has promised, this will be the book to have on your desk. (Ryan already blurbed it (back cover) as did Bill Bradley, Sam Nunn, George Shultz and Alan Greenspan.)

If you think entitlement programs, and the political hash that enacts them, are recent problems, or the fault of one political party, think again. John's main lesson is that the emergence of bloated entitlements is a hardy feature of our (and many other countries') democracies. He does this by just reading the history.

The habit of expanding entitlements started early. Chapter 2:

Revolutionary War pensions were the nation's first entitlement program. ... between 1789 and 1793, the federal government agreed to pay annual pensions to Continental Army soldiers and seamen who became disabled as a result of wartime injuries or illness. [later, as an inducement to service]...

For forty years, Congress enlarged and expnaded these benefits until, by the 1830s, they covered virtually all Revolutionary War seamen and soldiers, including volunteers and members of the state militia and their widows, regardless of disability or income.That costs might balloon beyond forecasts was not a total surprise

Opponents of the 1818 law predicted that granting lifetime pensions to Revolutionary War veterans who were "in reduced circumstances" would be costly. Senator Nathaniel Macon of North Carolina observed, "Pensions in all countries begin on a small scale and are at first generally granted on proper consideration, an that they increase till at last they are granted as often on whim or caprice...[it] will on experiment, be found an endless task. It will drain any treasury, no matter how full."Yet, the service pension law of 1818, which granted such pensions to all revolutionary war veterans who were "in reduced circumstances"

produced a massive surge in applications and an unexpected and unprecedented cost to the Treasury. The law's proponents had estimated that fewer than two thousand veterans would qualify and that the annual cost might reach $115,000. But by the end of 1819, more than twenty-eight thousand individuals had applied... The 1818 law's annual cost to the Treasury had ballooned from $300,000 to a staggering $1.8 million. ..widespread charges of pension fraud and corruption. A law designed to assist destitute veterans was providing pensions to many financially well-off veterans and even many who had never fought for the nation's independence.